Ric Valentine vs AAA -- The Case of the Missing Insurance Policy (and much more)...

If you are interested in our "web summary with photos", scroll down past this list of documents!!

CA Dept of Insurance Complaint #1 - Ric V vs AAA -- now found here

CA Dept of Insurance Complaint #2 - Ric V vs CIG -- offline as of 10/9/2019 Currently in negotiations.

CA Dept of Insurance Complaint #1 - Ric V vs AAA -- now found here

CA Dept of Insurance Complaint #2 - Ric V vs CIG -- offline as of 10/9/2019 Currently in negotiations.

Chronology...

- 1997 - Ric became a customer of AAA car insurance since.

- 2017/08/30 - AAA sent Ric a Declaration Page prior to renewal (note the low cost of his policy...) Note the declaration type as a "renewal certificate". Note renewal certificate reference on the second page. - view

- 2017/08/31 - AAA sent out a renewal bill. The bill indicated a due date of 10/4/2017. It indicates policy renewal documents were sent prior (reference to declaration page prior) . view

- 2017/09/22 -- AAA sent out a payment reminder with a due date of 10/4/2017. The notice stated the amount due was an account balance. The notice stated the past due amount was $0,00. This notices leads a consumer to believe this is the continuation of an existing agreement and it leads the consumer to believe there is a reasonable late payment (past due) handling process. view

- 2017/09/29 -- Ric wrote checks for bills. Seemingly a payment was thought to have been mailed or called in on that day. There is a hand written notation of 9/29 on the statement. (But to be clear, we are not disputing the fact that no payment was processed by AAA). view

- 2017/10/04 - This was the Renewal date/Due Date/Expiration Date for AAA insurance policy. No related document, see docs above.

- 2017/10/05 - 2017/10/19 -- AAA was the only stakeholder on the planet that knew Ric was without insurance. No notices related to a late or missed payment were sent to Ric or anyone else. No cancellation notices were sent to Ric or anyone else.

- 2017/10/19 - (aquired in December 2018) -- "Proof" of notice provided from AAA to Bay Federal Bank of Cancellation effective 10/4/2019 -- view

NOTEs: (1) Bay Federal claims this notice was never received. (2) IMCOVERED.com does not show this notice. (3) The system used to convey the notice between insurance company and bank was/is LexusNexus -- a legal IT network ?!?! (4) This notice was sent 15 days after Ric's policy was cancelled. AAA claims the 15 day delay between cancellation date and notice was to accommodate late payments, yet they sent no late payment notice to Ric to stimulate a late payment?! (5) During the 15 day period between 10/4/2019 and 10/19/2019 AAA was the only stakeholder that knew Ric was an uninsured motorist. (6) The official reason given by AAA on the cancellation notice was "Cancellation Customer Request" !?! - 2017/10/19 - (aquired in December 2018) -- "Proof" of notice provided from AAA to the CA DMV notice of Insurance Cancellation as of 10/4/2019 -- view

Reason given was "Coverage Cancellation" - In October 2017 and November 2017 notices were sent from Bay Federal Credit Union about a lack of insurance. HOWEVER, these notices started before 2017/10/19 and they are clearly related to an automatic reminder system that triggers on prior policy expiration dates. The assumption at the time was that the policy information had not made it from AAA to the bank.

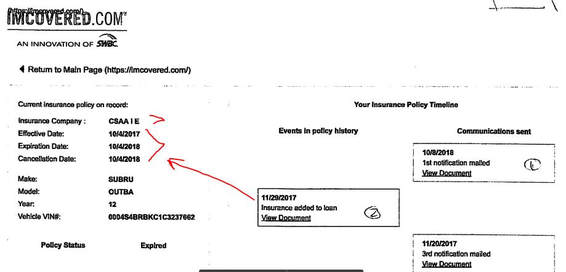

- 2017/11/29 -- Information was submitted to Bay Federal which indicates there was coverage from 10/4/2017-10/4/2018, but nothing about the data presented makes much sense. Data is in incorrect fields, and seemingly the information was not cross checked from AAA and/or did not originate from AAA. view << this doc only shows the document map and the 2017/11/29 drill down detail...

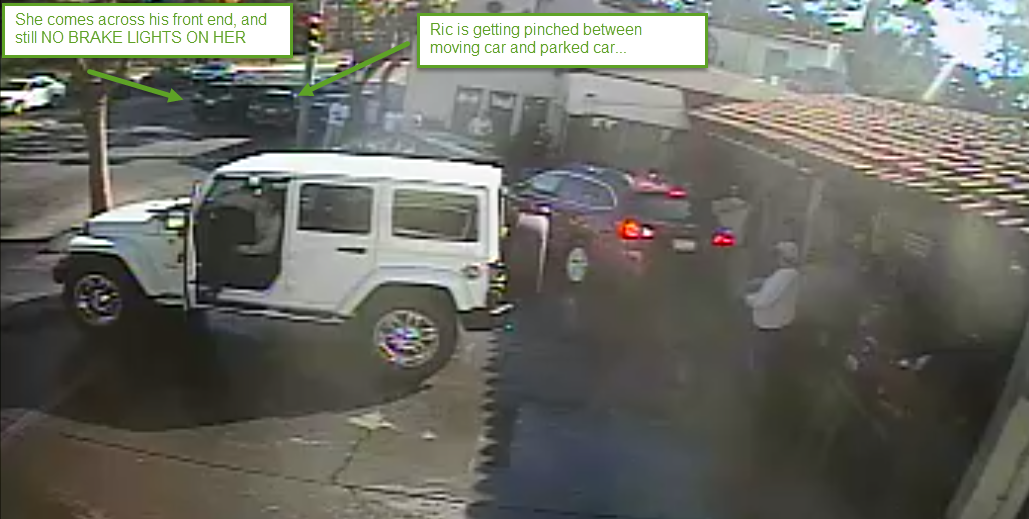

This next view link contains a screen shot of the Imcovered.com portal and ALL insurance related docs since 2015 . Conspicuously absent is the 2017/10/19 notice AAA supposedly sent to the bank -- and you can see waht the digital communciation cods look like with this document packet.... view - 2018/10/24 at 10:45am --- 12.5 months after 2017/10/04 Ric was in an accident involving his car, one other moving vehicle and a parked vehicle. There was approximately $15,000 in damage to the three vehicles total and no bodily injuries.

See 2a) Accident & Fraud Summary Exhibits at http://ric-vs-cig.bryancanary.com for photoes and accident details- Ric pulled out his insurance cards at the scene of the accident. He Realized they were old so called AAA to get information. In that call he was told he didn't have insurance and had not had insurance for 12.5 months (since 10/4/2017).

- Ric went to the AAA sales office in Monterrey directly from the accident.

- Chris Rauber issued him a new policy and had him sign a statement saying he didn't have insurance at time of accident.

- Chris Rauber indicated their policies are like "new policies" each year and thus were not subject to cancellation notices.

- CIG contacted Ric by cell phone for a statement. He was driving and he told them he'd call them back.

- State Farm contacted Ric by cell phone and he made a statement.

- Ric called Angelica at CIG back and got her voicemail. He left a message (see phone records).

- Ric tried to make a statement to CIG but was never able to do so (see http://ric-vs-cig.bryancanary.com for all further accident and CIG details)

- 2018/10/29 - DMV sent Ric a notice of car registration suspension for lack of insurance effective as of 1/22/2018.

Notes (1) This is the only notice from DMV regarding an insurance cancellation problem and it was delivered over 1 year after AAA supposedly notified the DMV of the insurance matter. (2) This notice was issued on the day we were getting very aggressive with AAA asking for notice details from 2017 (3) The effective date of this makes no sense to any of us (4) The timing of the notice sure alludes to the idea someone covered their tracks with a DMV notification after the accident - view - 2018/10/27 - 2018/11/07 -- Emails with local AAA Branch. Sales Person Chris Strauber, and his sales supervisor Carmen Jones. These emails reveal various types of information (email dialogue highlights posted with 11/30 DOI complaint information )

- 2018/10/31 - 2018/11/29 -- emails with Josh at Corporate reveal various types of information (email dialogue highlights posted with 11/30 DOI complaint information ). This is when he provides the 2017 notices.

- 2018/11/30 - A claim was mailed to the California Department of Insurance against AAA for improper notification processes.

- 2018/12/10 - CA Department of Insurance acknowledges complaint -- view

- 2018/12/14 - AAA issued a written response to our complaint glossing over the most relevant parts -- view

- 2018/12/18 - AAA issued a written response to our complaint detailing claims filed by others and those denials -- not relevant since no disagreement on dates policy did or did not exist -- view

- 2018/12/24 - We responded to AAA's 12/14/2018 response. We clarify the complaint mis-characterization and resort to a "circle the right answer" for legal association of AAA documents to CA statutes... -- view

- 2018/12/25 - 2019/01/16 - Cat had AAA's tongue. They were silent. A nudge to the CA DOI was required to stimulate a response.

- 2019/01/17 - AAA responded with 1.25 pages of inverted prose that required inference that could lead to incorrect understanding. view

- 2019/01/30 - We responded asking Tricia for clear answers that don't require inverted prose reading skills and inference. We detail the path AAA has taken into the Statute Rabbit Hole. We detail what industry standards are . We provide simple and clear suggestions for Statute changes to close this black hole. We ask a lot more relevant questions. This document is UNORTHODOX. -- view

- xxxx - Tricia replied back without answering any more questions...

Other Documents

Internet Forum Explaining Industry Wide Problems and issues with E and O insurance representatives pushing estoppel concepts to disrupt free flowing dialogue between agents and consumers

- Internet forum where Insurance Agents are discussing the legality and ethics of notifying their clients when cancellation notices are issued. Generally speaking, many believe they should NOT call their own clients due to estoppel related issues as pressed by E and O seminars... https://www.insurancejournal.com/forums/viewtopic.php?t=5711 for pdf print outs of this forum, click here

Industry Standard Cancellation Notices...

AAA late notice for their towing service

AAA late notice for their towing service